Reinventing the driver’s wheel

Everyday around 9:15 am my quest for getting a ride begins. Booking one, keeps me waiting for like… eternity. Prancing inside the cab is followed by sighing with utmost pleasure.

Thank heavens for the modern day innovation! On demand transport is available at the tap of a button. If not this, office-going and daily commuters would be dwindling with much possible anxiety in this rat race stricken world.

When thronged by your co-passengers in the cab, seconds seem to pass like hours. Happens with me too. Well, that is the exact chunk of time when I :

- Get lost in BoJack Horseman’s existentialism

- Think profusely about the customer & driver dynamics (‘coz that’s my job!)

It has been nearly 2 months at my new work and I have been bemused by this lucrative pool of driving for ride-hailing firms.

The 1.5 million drivers on India’s app-based cab services in the past three years have come across different shades. From riders being pampered with incentives, to complaints of frequent surge in pricing, to drivers facing decline in incomes.

I enjoy my regular, light-hearted banter with the drivers — both off and on duty. But the recent strikes have made me wonder what are the latest round of demands presented by these cab drivers? Are these legitimate demands, and can cab aggregators or regulators do something about them?

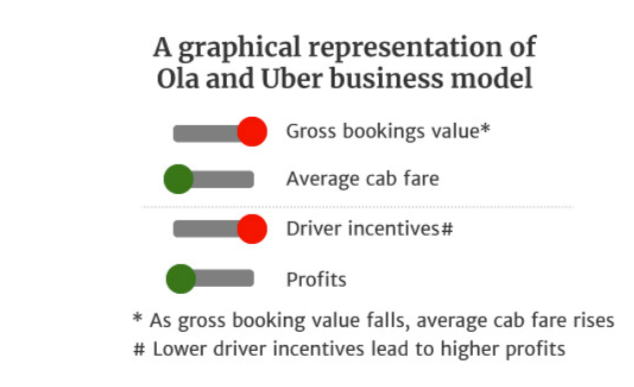

One thing that the competitive ferocity in the ride-hailing market has done is increase the total volumes. The gross bookings value of online cab aggregators grew 40% between 2016 and 2017, fuelled by massive investments.

Flush with funds, these firms incentivised drivers heavily with high rates of commission. However, with the massive increase in the number of drivers and with the companies increasingly focusing on profitability, drivers’ finances have worsened.

As the cab aggregators started bleeding, incentives were cut, which eventually led to protests by drivers.

Ex- TaxiForSure angel investor Rahm Shastry has been brewing something different. He has come up with DriveU as an alternative- aggregate drivers with private cars. Here, drivers don’t need to own or lease cars. They just drive. The process, itself has secured a space that may not witness blistering growth, but is less bloody compared to the battlefield chosen by Ola and Uber.

Aiming for a smaller market, DriveU has positive unit economics — with a per-trip margin of INR 60 or 15%, on an average trip size of INR400. Its revenue grew from INR 1 crore in 2016 to INR 4 crore in 2017. But the positive unit economics are yet to translate into overall profitability.

The crucial question : How will the company scale up?

Owning a first car is still an aspiration for many, and the demand is going to remain high.

DriveU is targeting cities with high car ownership. What may work in its favour is the fact that about 60% of India’s population will live in cities by 2050, a dramatic rate of urbanisation.

A niche but viable alternative.

For those who want to enjoy their drink on their evening out and not drive; elderly people who may be unable to drive; people who need errands to be done; those with erratic work schedules; enterprise clients, and outstation travellers — these constitute most of DriveU’s client list.

These people are not driven only by price consciousness, reflecting in DriveU’s higher average booking duration of four hours and fares of INR400, compared to the average Ola/Uber fare of around INR130. This is also 33% higher than neighbourhood driver services.

With no leases or cars to maintain, DriveU drivers don’t have to recover car expenses before they make money. Money gets transferred to their bank accounts weekly instead of monthly. Also, city-specific incentive schemes help them improve income. There are also the usual insurance schemes and professional-training programmes. Interestingly, it is this focus on driver enablement that got Rahm his first investment from Unitus.

While interviewing our drivers along with ET Prime , this is what Mohammed Islam (our driver partner) had to say —

“I can’t afford to buy or lease a car, which is what Uber and Ola need drivers to do. This way, as long as I have a driving license, I can drive and earn. And I don’t have to spend in return.”

What lies ahead?

There are still issues to sort out — higher waiting time for drivers between rides, the low-demand cycles, and late-night commute safety for the drivers.

Meanwhile, the market gets another option to choose from. Utilising existing vehicles instead of adding more cars to the already-congested roads on the one hand, and enabling drivers to drive without forcing them to become owner-operators on the other, will continue to be a niche experience.

Even as Ola and Uber promise to be everyone’s private drivers, DriveU and the likes can actually bring the competition home as long as the economics work out — for them, for private-car owners, and for drivers.

*For the full insight read this article on ET Prime : https://prime.economictimes.indiatimes.com/news/64087118/technology-startups/remember-the-time-when-drivers-just-drove-driveu-wants-to-bring-it-back- *

We built DriveU around the belief that when people are treated better, they provide better service. Happy drivers, happy riders!

Reinventing the driver's wheel was originally published in DriveU Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.